Nvidia, the world's most valuable company?

Week of June 24th, 2024

Welcome to AI8’s weekly newsletter, your ultimate source for curated insights and updates from the dynamic world of venture capital!

We’ve scoured the vast landscape of the web to bring you a comprehensive roundup of the industry’s top news articles, all in one convenient place. We keep you ahead of the game and in the know about all things related to the vibrant world of investments

STARTUPS

ROUNDS AND UNICORNS

The Week’s Biggest Funding Rounds: Biotech And Cybersecurity See Big Bucks (Crunchbase, 5 minute read)

Marea Therapeutics (biotech): raised $190 million in a combined Series A and B financing to develop medicines for cardiometabolic diseases

Huntress (cybersecurity): raised $150 million in a Series D round led by Kleiner Perkins, Meritech Capital Partners, and Sapphire Ventures. This funding round brought Huntress to a valuation of over $1.5 billion

Talkiatry (healthcare): secured $130 million in a mix of equity and debt financing led by Andreessen Horowitz. The company provides in-network psychiatry and therapy to address the mental health needs of adults in the U.S.

Semperis (cybersecurity): raised $125 million in growth financing from J.P. Morgan and Hercules Capital, valuing the company at $1 billion. Semperis specializes in protection for Microsoft directory services

Elion Therapeutics (biotech): raised $81 million in a Series B round, the company focuses on treating life-threatening invasive fungal infections

Mega-deals dominate AI’s horizontal platform startups (Pitchbook, 4-minute read)

The AI venture landscape is dominated by mega-deals, particularly in the horizontal platforms segment —those building, deploying or fine-tuning AI models—

Notable investments include xAI's $6 billion Series B, Mistral AI's $640 million raise, and Cohere's ongoing talks for a $450 million round

Despite a slight dip in overall funding from 2022 to 2023, Q1 2024 saw $10.3 billion raised by horizontal platform companies, reflecting sustained investor interest

INDUSTRY

Metaverse And Augmented Reality Remain Unpopular With VC (Crunchbase, 4 minute read)

Investment in startups focused on the metaverse, virtual reality, and augmented reality roughly raised $464 million this year, reflecting waning interest from venture capitalists

In 2024, funding for AR, VR, and metaverse startups is on track to reach its lowest point in years, with many once-prominent companies struggling to secure new investments

So far in 2024, the largest AR-related round went to Rokid, a maker of augmented reality glasses that raised $70 million in a January financing

VC funding for AI visual media surges nearly 90% (Pitchbook, 4 minute read)

In the realm of AI-generated visual media, startups are seeing increased investment as they cater to enterprise needs, such as marketing and design applications. Unlike broad-use large language models, these startups offer specialized solutions, like personalized content creation for sales teams

Q1 2024 saw a notable uptick in funding, with AI visual media deal values reaching $402.7 million, a 90% increase compared to the previous quarter

This uptick was driven by investments in companies like Tavus ($18M), Photoroom ($43M), and Kittl ($36M)

INDUSTRY INTERNATIONAL

Unicorn count may rise to 152 in 5 years with valuation over $1 billion (Economic Times, 3 minute read)

A transformative shift is in progress in the dynamic landscape on India’s startups. India is expected to add at least 152 unicorns from 31 cities over the next 3.5 years to its current rally of 67 unicorns

On average, most of these identified future unicorns were set up in 2015, with most of them selling software and services

Only 18% of them sell physical products, around 44% sell to business and 56% are consumer-facing

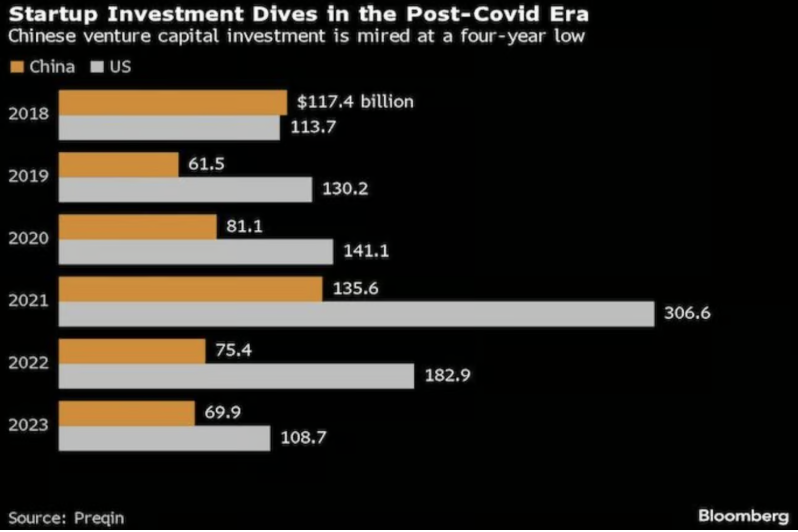

China Plans New Measures to Attract Venture Capital Investment (Bloomberg, 4 minute read)

China is planning to implement new measures aimed at boosting venture capital. These efforts come as China prioritizes achieving technological self-sufficiency, particularly in chip design and manufacturing, amid concerns over US policy impacts

Key measures include allowing overseas investors to establish yuan-denominated funds in China to facilitate local investments

Venture capital investment in China saw a decline of over 7% in 2023, marking its lowest level in four years. The total value of investments dropped to $69.9 billion across approximately 4,200 deals

ECONOMIC SNAPSHOT

Nvidia becomes world’s most valuable company amid AI boom (The Guardian, 3 minute read)

Nvidia has become the world's most valuable company, surpassing Microsoft. The chipmaker's stock surged, reaching a market capitalization of $3.34 trillion, following a recent 10-for-one stock split

The company’s growth has outpaced other household names in the tech industry including Google and Apple

The stock has surged about 180% so far this year, compared with a rise of about 19% in Microsoft shares

The company's chips have fueled its rapid rise in stock price, increasing CEO Jensen Huang’s net worth by more than $100bn in total

Nvidia’s shares are on fire. The broader market looks less rosy (CNN, 6 minute read)

The stock market in 2024 has seen significant gains driven largely by mega-cap tech stocks like Nvidia, which has surged 164% this year alone. These gains have propelled indices like the S&P 500 to multiple record highs. However, beneath the surface, the market's performance appears uneven

The S&P 500 equal-weighted index, which gives every stock the same weighting, has risen just 4% this year

Coming out of first-quarter earnings, when you exclude the Magnificent Seven’s earnings, growth was actually down 2% year-over-year

While Nvidia's rise has fueled market optimism, the concentration of gains in a few tech giants poses questions about broader market stability and future growth trajectories

What To Expect From The Fed On Interest Rates For The Rest Of 2024 (Forbes, 5 minute read)

The Federal Reserve Open Market Committee (FOMC) is anticipated to cut interest rates at least once during its remaining four meetings in 2024, with two cuts being the most likely scenario according to the CME FedWatch Tool. The potential first cut may occur in September, followed by possible cuts in November and December

Policymakers' forecasts suggest one or two interest rate cuts in 2024, though some believe rates will remain in the 5.25%-5.5% range

Inflation stands at just under 3.5% as of May 2024, down from its peak in summer 2022

The FOMC aims for a 2% inflation target and will ensure inflation is on track before cutting rates

IMPACT & CLIMATE RESILIENCE

Companies Downplaying DEI Executive Pay Goals (Insurance Journal, 5 minute read)

A recent analysis by Farient Advisors and Strive Asset Management reveals that a growing number of major U.S. companies are revising their executive pay metrics, moving away from Diversity, Equity, and Inclusion (DEI) goals. Initially, about 33% of companies used DEI metrics for compensation, but this has dropped to 28% in 2024

This shift comes amid conservative criticism that linking executive pay to DEI metrics may lead to improper hiring practices

Some companies, such as Carnival and PayPal, have replaced DEI metrics with broader terms like "culture of belonging" or "workplace equality," although they maintain that DEI remains a priority

Rescuing diversity from the DEI backlash (Financial Times, 7 minute read)

In his annual shareholder letter, JPMorgan Chase CEO Jamie Dimon reiterated the bank's commitment to diversity, equity, and inclusion, highlighting their positive impacts on innovation and financial performance. This comes amidst evolving legal landscapes and societal shifts challenging DEI practices globally

Despite legal uncertainties, companies are doubling down on DEI strategies, driven by demographic changes and the imperative to attract and retain diverse talent

DEI efforts now encompass diversity beyond race and gender, including neurodiversity and socio-economic background, reflecting broader workforce expectations

IPO & EXITS

Hyundai: India’s biggest IPO could come from South Korean car manufacturer (CNN, 3 minute read)

Hyundai Motor's India unit has filed for regulatory approval to launch an IPO on the Mumbai stock market, potentially becoming India's largest IPO to date

The IPO marks the first public listing of a car manufacturer in India in two decades, following Maruti Suzuki in 2003

The South Korean parent company plans to sell up to 17.5% of its stake in Hyundai Motor India, aiming to raise between $2.5 to $3 billion at a valuation of up to $30 billion

Hyundai's strategy post-IPO focuses on "premiumisation," expanding its electric vehicle market share, and bolstering its position as an export hub

Experts say Shein’s U.S. IPO is all but dead (CNBC, 4 minute read)

Shein, the China-founded e-commerce giant, is facing increasing challenges in its pursuit of a U.S. IPO amid rising political tensions between Beijing and Washington

Originally valued at $66 billion, Shein had filed confidentially for a U.S. IPO in November but has encountered significant resistance, including being rejected by the National Retail Federation

As obstacles mount in the U.S., Shein is preparing to file for a £50 billion IPO in London in the coming weeks

Despite relocating its headquarters to Singapore, Shein's substantial manufacturing operations in China raise questions about data sharing with the Chinese government

Luxury sneaker maker Golden Goose postpones IPO citing political turmoil in Europe (CNBC, 3 minute read)

Golden Goose has decided to postpone its IPO in Milan. The company aimed to achieve a market capitalization of up to 1.86 billion euros ($2 billion) but cited a significant deterioration in market conditions following the European Parliament elections and the announcement of a snap election in France

Golden Goose emphasized that it had engaged extensively with investors during the IPO process, with plans for trading to commence on June 14th

Prior to postponing the IPO, Golden Goose had secured Invesco as a cornerstone investor, committing 100 million euros to support the listing

AI8 VENTURES HIGHLIGHT

AlphaInsights: Venture Capital Report 2023

Alpha Impact 8 Ventures is thrilled to share our latest insights into the dynamic world of investments with our 2023 Venture Capital Report, here’s an updated version with 2024 commentary that dives into the ever-evolving landscape of financial markets.

Just a few months ago, Michael Burry, the legendary fund manager who famously profited from shorting the US housing market in 2008, bet more than $1.6 billion on a Wall Street crash by shorting the S&P 500 and Nasdaq-100. Warren Buffett’s money pile reached record highs of $157 billion as Berkshire Hathaway disposed of a net $33 billion of stocks over the past three quarters. Is there something Buffett and Burry know that the rest of us don’t?

Alpha Impact 8 Ventures is disrupting the industry, generating wealth, creating technology, providing access, leveling the play field, reducing systemic barriers, and building a resilient world.

Become part of the our revolution.

Happy reading,

AI8 Ventures’ Research & Investment Team